The office real estate market is bracing itself for a challenging year ahead. With disruptive industry trends and impending financial maturities, owners are facing a daunting task. Recent data from Trepp reveals that a staggering $2.77 trillion of commercial real estate debt, half of the total outstanding debt, is set to mature between 2023 and 2027. And of this, almost $500 billion is due in 2024 alone.

This impending maturity cliff, combined with declining property values and persistently high interest rates, poses a significant challenge for lenders and borrowers seeking to refinance this massive volume of debt.

Office Real Estate Industry Confronts Major Hurdles

Dr. Stephen Buschbom, the research director at Trepp, highlights the serious challenges caused by higher interest rates and tighter liquidity in the commercial real estate (CRE) and CRE debt markets. He draws comparisons to past economic cycles, noting, "Maybe the office delinquency rate hits 7%, and I think if you're talking about urban office, non-defeased, that still is a reality."

Buschbom also mentions an increase in loan modifications and creative capital structuring, expressing hope for a potential decrease in rates later in the year. However, he cautions about potential complications arising from banking regulations and geopolitical risks that could further restrict liquidity.

Fed Beige Book's Warnings

The latest Fed Beige Book highlights suppressed commercial real estate transactions in the Kansas City district. Additionally, concerns about credit performance and borrower liquidity have hindered CRE loan modification activity.

Lauren Hochfelder, co-CEO of Morgan Stanley Real Estate, shares in a Bloomberg interview that certain factors are reviving the commercial real estate markets after two years of sluggishness. She mentions the resurgence of reshoring to the U.S. and friend-shoring, which have generated demand for warehouses, especially along the Mexican border. The healthcare sector is also showing promise, with increased investment in medical and life sciences offices.

However, Hochfelder warns of choppy areas in the commercial real estate market, characterized by an oversupply of properties and excessive debt.

CRE Stocks On The Decline

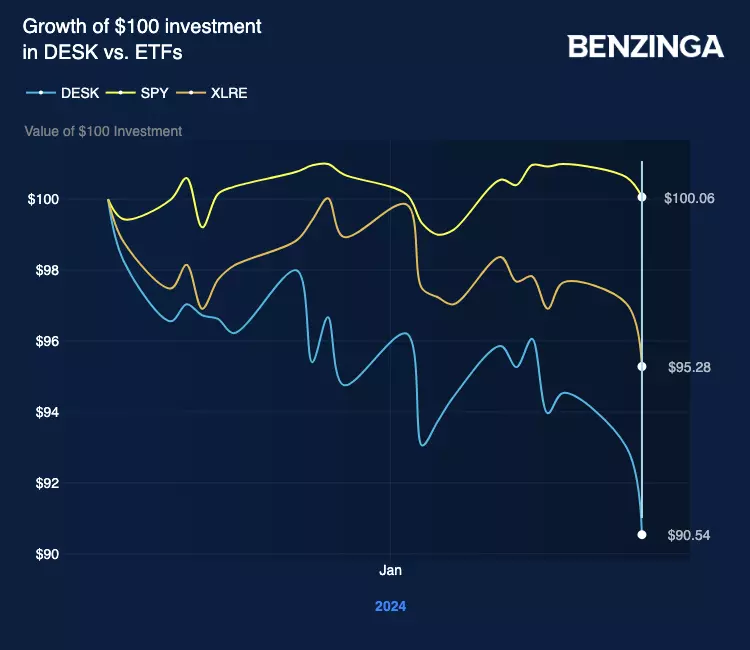

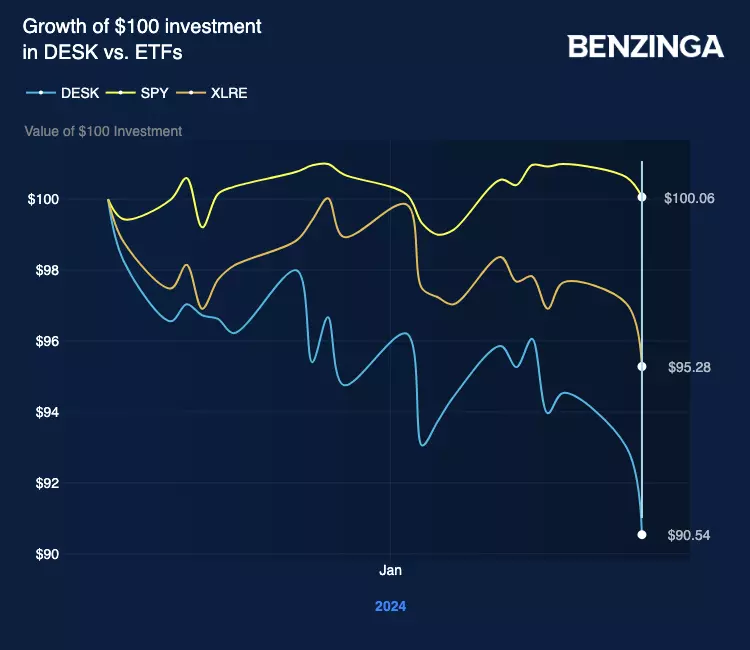

Despite initial optimism for rate cuts in 2024 providing relief to the real estate sector, the year's start has challenged these expectations. Rising global instability and U.S. economic strength have forced Fed members to reconsider early rate cut hopes. Consequently, stocks in the office real estate sector, tracked by the VanEck Office and Commercial REIT ETF (NYSE: DESK), have declined by 10% from their late December peak.

The chart below illustrates the underperformance of this segment compared to the SPDR S&P 500 ETF Trust (NYSE: SPY) and the broader real estate sector, as indicated by the Real Estate Select Sector SPDR Fund (NYSE: XLRE).

Worst-Performing CRE Stocks Year-To-Date

- Office Properties Income Trust

- Orion Office REIT Inc.

- Hudson Pacific Properties, Inc.

- Paramount Group, Inc.

- Vornado Realty Trust

- Kimco Realty Corporation

Investing in real estate has its challenges, especially in the current market. However, opportunities still exist for those willing to navigate the complexities and find value. Stay informed and make well-informed investment decisions.

Photo by Jason Dent on Unsplash