Investors often hope to strike it rich on Wall Street, searching for that winning lottery ticket. With Annaly Capital (NLY -0.15%) and its impressive 13.5% dividend yield, some may believe they have found the ticket to a seven-figure portfolio. However, history suggests that this investment may not live up to expectations.

This dividend record doesn't track

While Annaly's high dividend yield is undoubtedly attractive, it's important to understand the backstory behind it. The yield is elevated because the stock has a long history of dividend cuts, and the stock price has followed suit. Over the past decade, both the dividend and the stock price have steadily declined, resulting in less dividend income and capital for investors. This is not the path to joining the millionaire club.

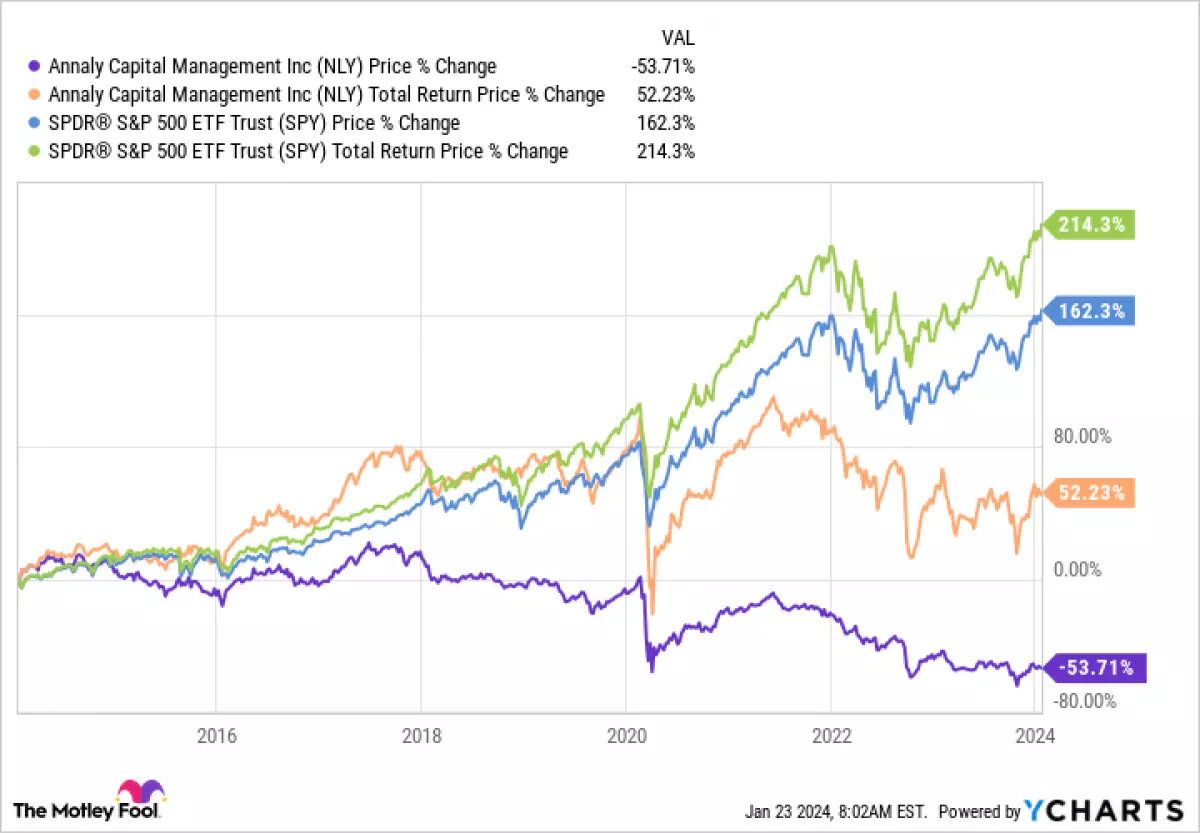

To be fair, reinvesting dividends over the past decade has had a positive effect on return. Despite a 50% decline in stock price, reinvesting dividends would have resulted in a total return of 50%. This showcases the power of dividend reinvestment and compounding. However, when compared to the S&P 500 Index, which achieved a 150% stock-only gain and a 210% total return over the same period, Annaly falls short of being a millionaire maker.

Figure: Annaly Capital Stock Chart

Figure: Annaly Capital Stock Chart

So what's the point of Annaly?

Annaly is a mortgage real estate investment trust (REIT) that purchases pooled mortgages known as collateralized mortgage obligations (CMOs). While this approach is unique in the REIT sector, it is not inherently problematic. However, it is crucial to thoroughly understand Annaly's business model before considering an investment.

The larger purpose of Annaly is not to cater to small investors seeking income from their portfolios. The volatility of its dividends and the difference between total return and stock price return indicate this. Annaly primarily provides exposure to mortgage-backed securities for investors interested in such exposure. It is not intended to be an income investment like most property-owning REITs.

Traditionally, large institutional investors, such as pension funds focusing on asset allocation, would be interested in owning Annaly. For these investors, dividend income is not crucial for daily expenses, and total return with dividend reinvestment takes priority. Annaly is a suitable option for mortgage exposure within an asset allocation strategy. However, if you are a small investor with a dividend focus, asset allocation is likely not your primary goal.

Don't get distracted by the big yield

The problem for investors lies in the massive 13.5% dividend yield, which can incite an emotional reaction. It may lead people to believe that there's a chance to "get rich quick," but Annaly's story is not that simple. If your goal is to join the millionaire club, you are better off sticking to lower-yielding stocks with more consistent dividend histories. Fortunately, the REIT sector offers plenty of options in this regard.

In conclusion, while Annaly Capital's high dividend yield may initially appear attractive, its track record and purpose should give investors pause. To achieve long-term success and build wealth, it is wise to seek out lower-yielding stocks with reliable dividend histories. And remember, true wealth is built over time, not overnight.