Real estate investment trusts (REITs) are a valuable asset class for generating steady income in your portfolio. With higher dividend yields compared to the average stock, REITs can be an excellent addition to your investment strategy. In this article, we will explore the benefits of REITs, provide a comprehensive list of U.S. REITs, and highlight our top 7 REITs based on expected total returns.

Why Invest in REITs?

REITs are specially designed to provide investors with income generation opportunities. These securities allow you to benefit from real estate ownership without the hassle of being a traditional landlord. With monthly rental cash flows, REITs are well-suited for income-focused investors. The primary metric of interest for many REIT investors is the dividend yield.

How to Use the REIT List to Find Dividend Stock Ideas

Microsoft Excel can be a powerful tool for filtering and identifying high dividend REITs. For those unfamiliar with Excel, we have provided step-by-step instructions on how to filter for REITs with dividend yields between 5% and 7%. This filtering process helps eliminate REITs with exceptionally high, and possibly unsustainable, dividend yields. By following these simple steps, you can identify high-quality REITs for your portfolio.

REIT Financial Metrics

REITs have unique business models that primarily involve owning long-lived assets. As a result, they incur significant non-cash depreciation and amortization expenses. These expenses can impact a REIT's net income, potentially leading to a higher dividend payout than net income suggests. To better understand a REIT's financial performance and dividend safety, the industry developed the financial metric called funds from operations (FFO). FFO represents a REIT's ability to generate cash flow and pay dividends.

Top 7 REITs for Expected Total Returns

Based on our analysis, we have ranked the top 7 REITs with expected total returns. These rankings consider dividend yield, expected growth, and valuation multiple changes. It is important to note that while these REITs offer high expected total returns, they may also carry elevated risks. We encourage you to consider the risk/reward profile of these investments before making any decisions. You can download our comprehensive report on each REIT, providing an in-depth analysis of their financial performance and growth prospects.

-

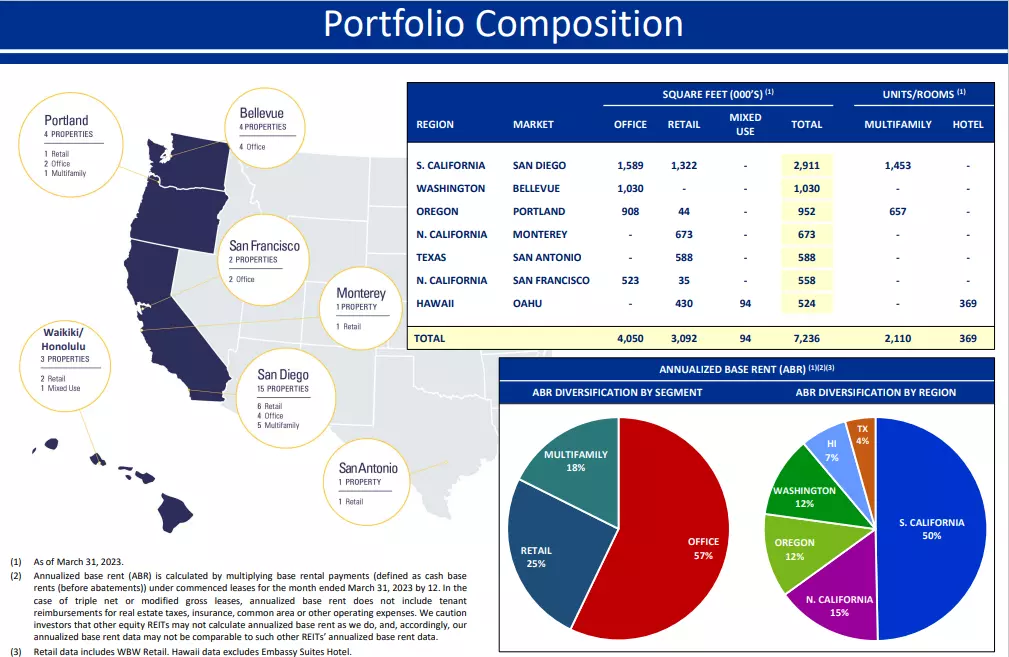

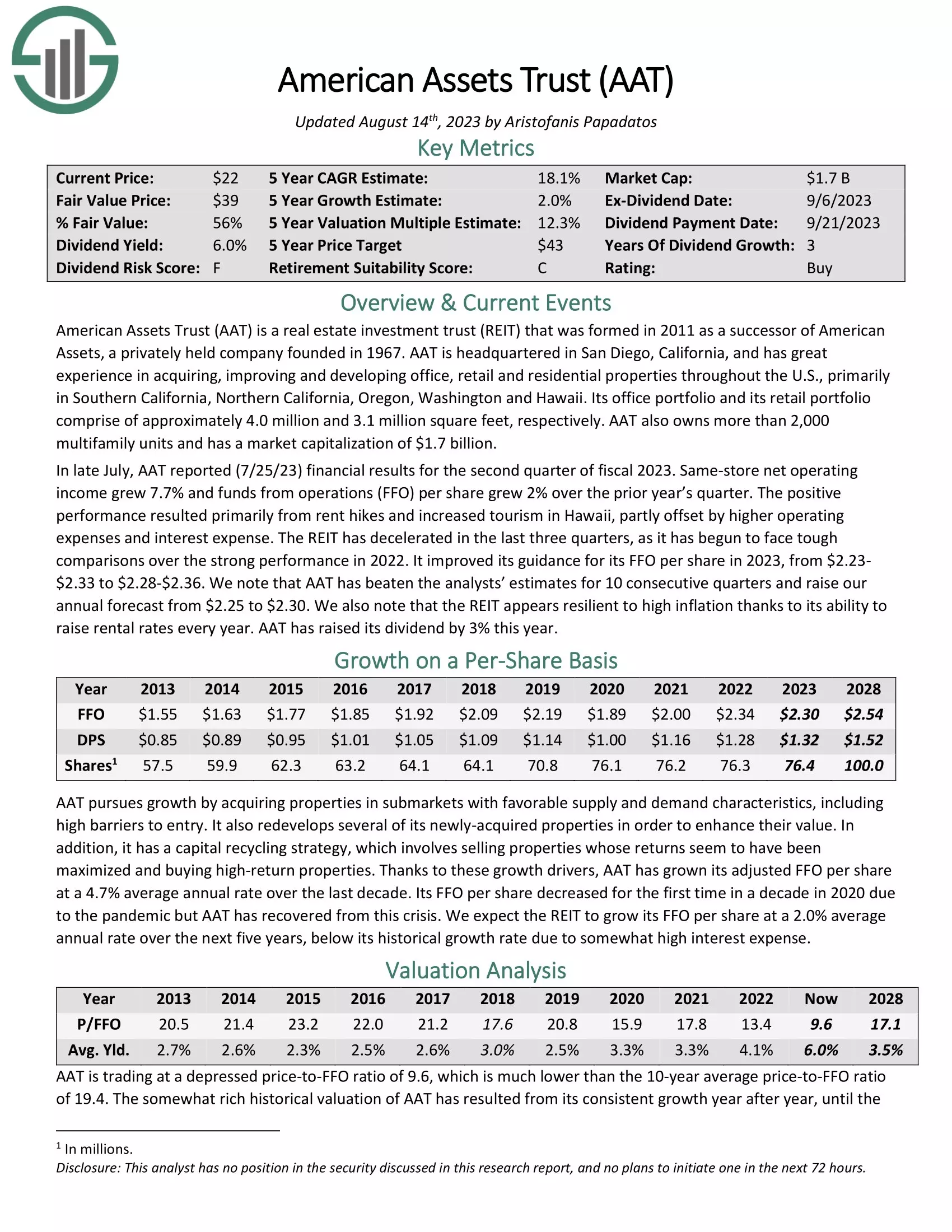

American Assets Trust (AAT)

- Expected Total Return: 16.5%

- Dividend Yield: 5.6%

-

UMH Properties (UMH)

- Expected Total Return: 16.8%

- Dividend Yield: 5.2%

-

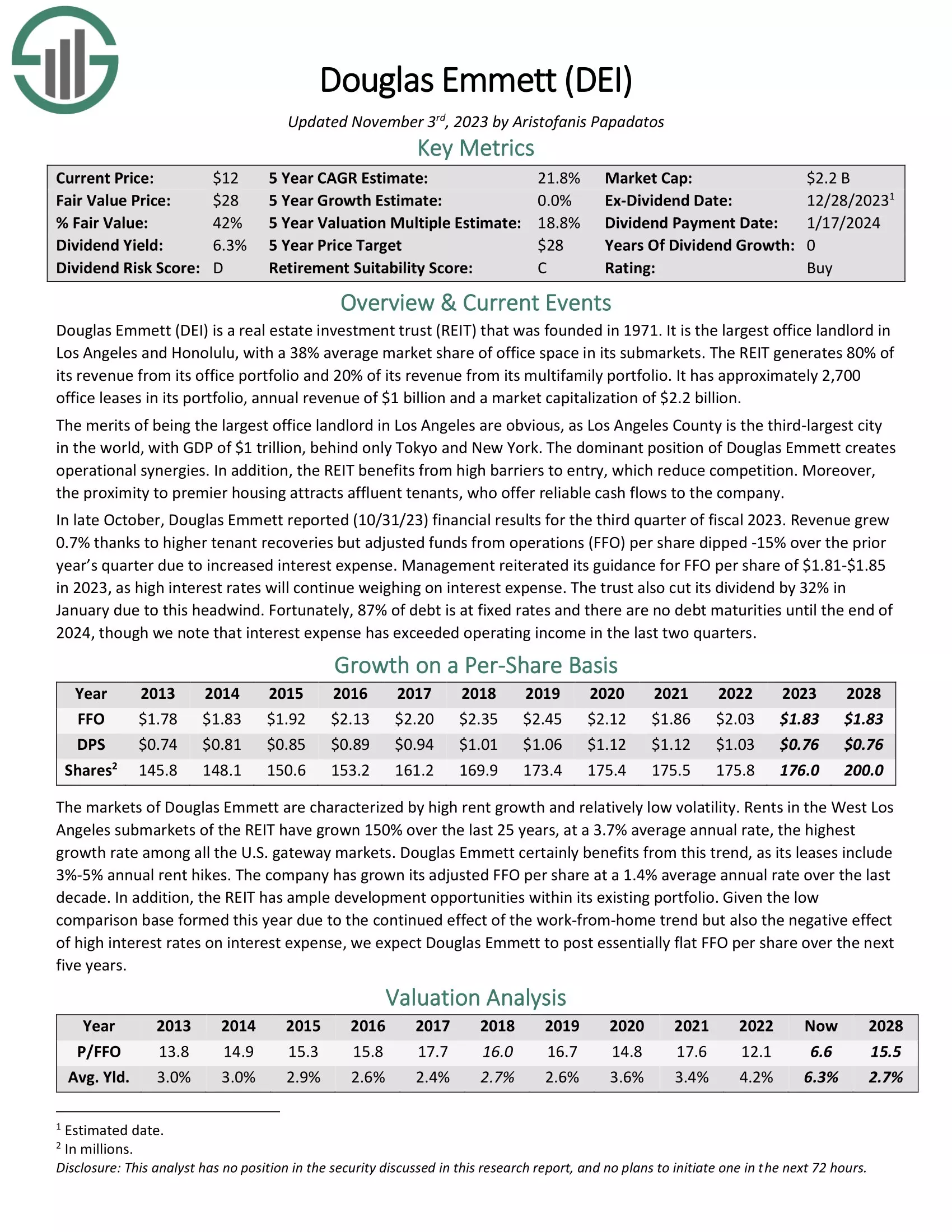

Douglas Emmett Realty (DEI)

- Expected Total Return: 17.6%

- Dividend Yield: 5.4%

-

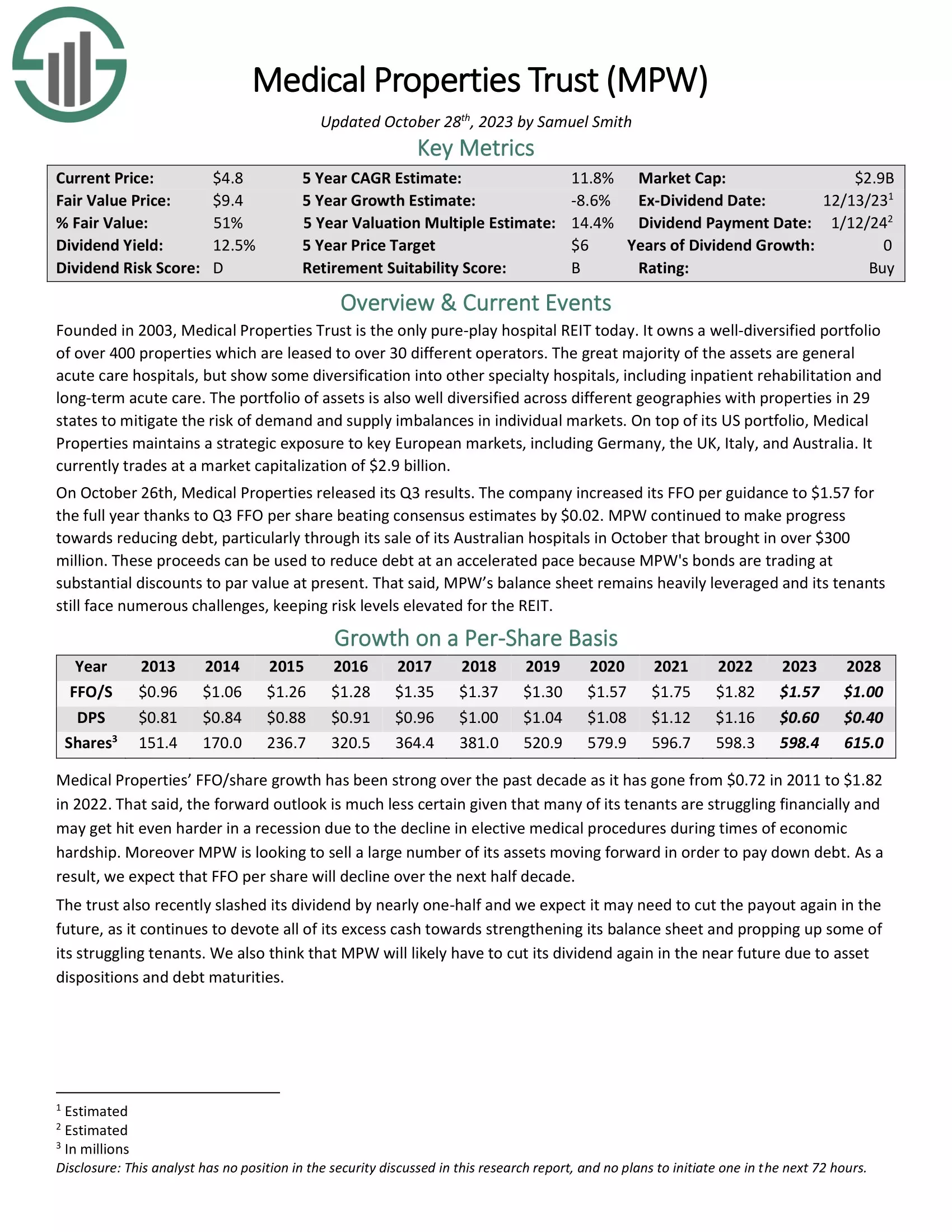

Medical Properties Trust (MPW)

- Expected Total Return: 17.0%

- Dividend Yield: 8.8%

-

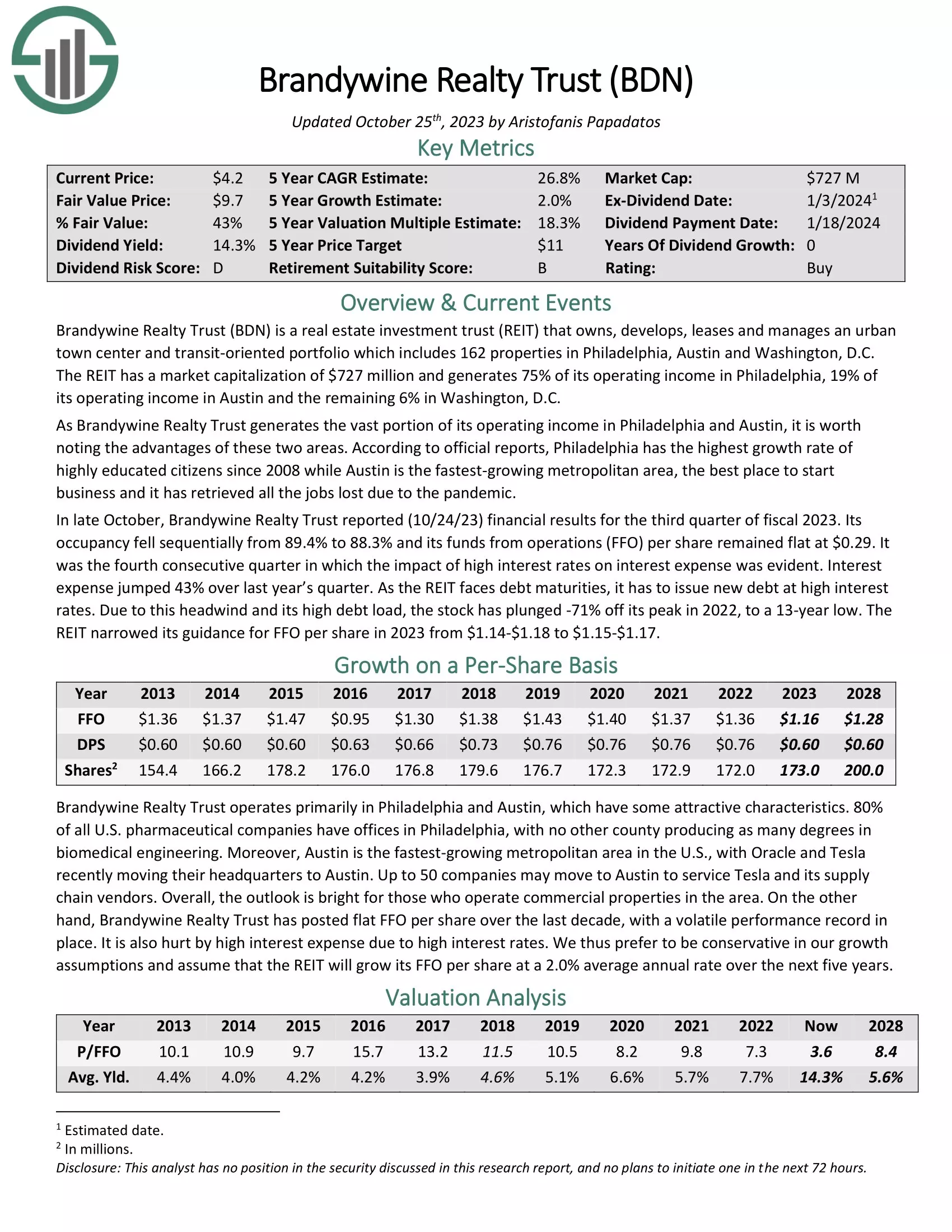

Brandywine Realty Trust (BDN)

- Expected Total Return: 19.8%

- Dividend Yield: 12.8%

-

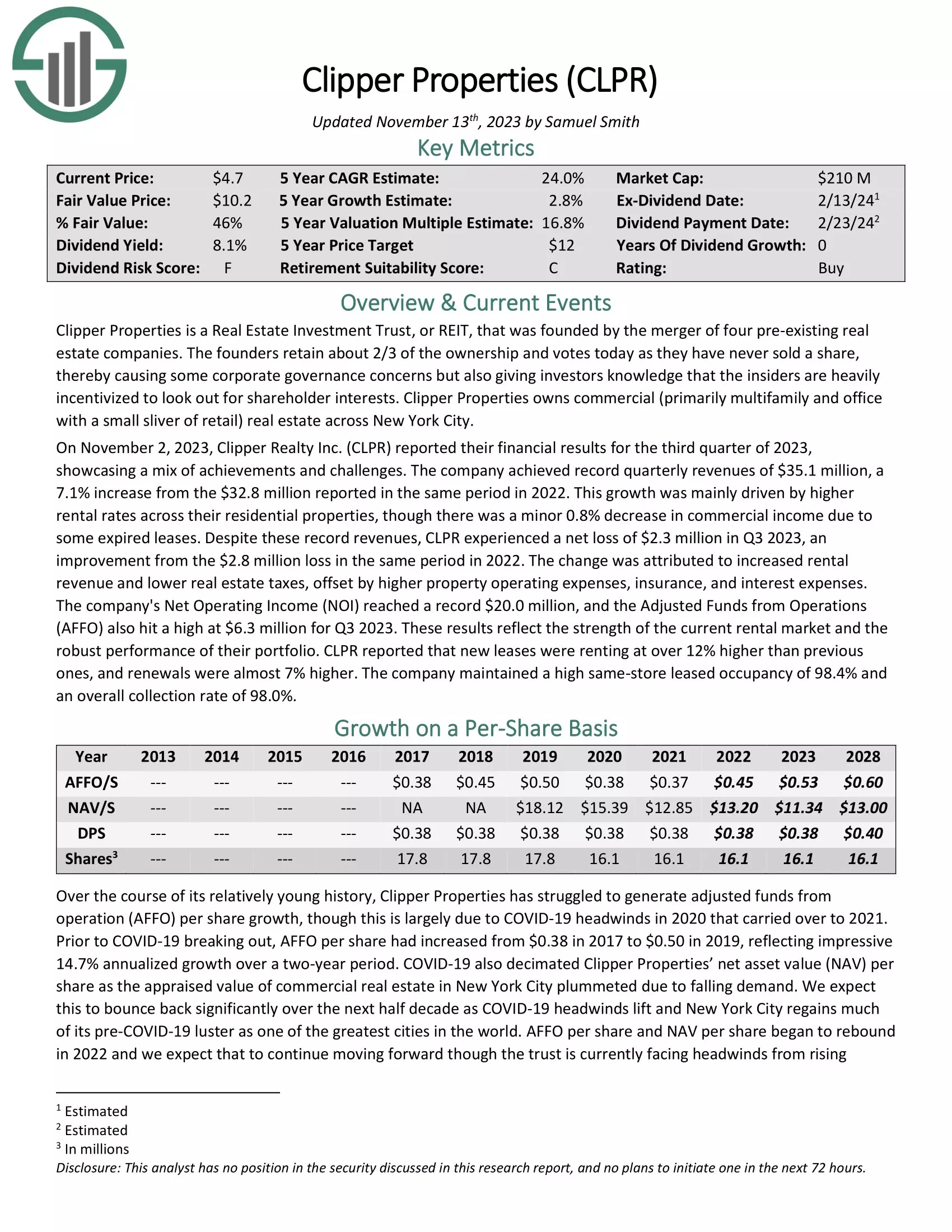

Clipper Properties (CLPR)

- Expected Total Return: 21.3%

- Dividend Yield: 7.3%

-

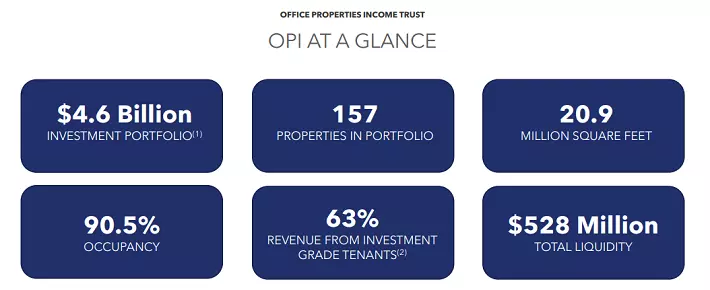

Office Properties Income Trust (OPI)

- Expected Total Return: 39.4%

- Dividend Yield: 25.8%

Final Thoughts

REITs can be an excellent addition to your investment portfolio, providing steady income and diversification. Our comprehensive REIT list offers valuable insights into the world of real estate investment trusts. However, it's important to remember that REITs are just one option when seeking high-quality dividend stocks. Considering stocks with a long history of steadily rising dividends can also be a wise strategy. Explore our other databases, including Dividend Kings, Dividend Aristocrats, and Blue Chip Stocks, to discover more high-quality dividend stocks. Additionally, if you're targeting a highly customized dividend income stream, our lists of monthly dividend stocks can provide useful information. Happy investing!