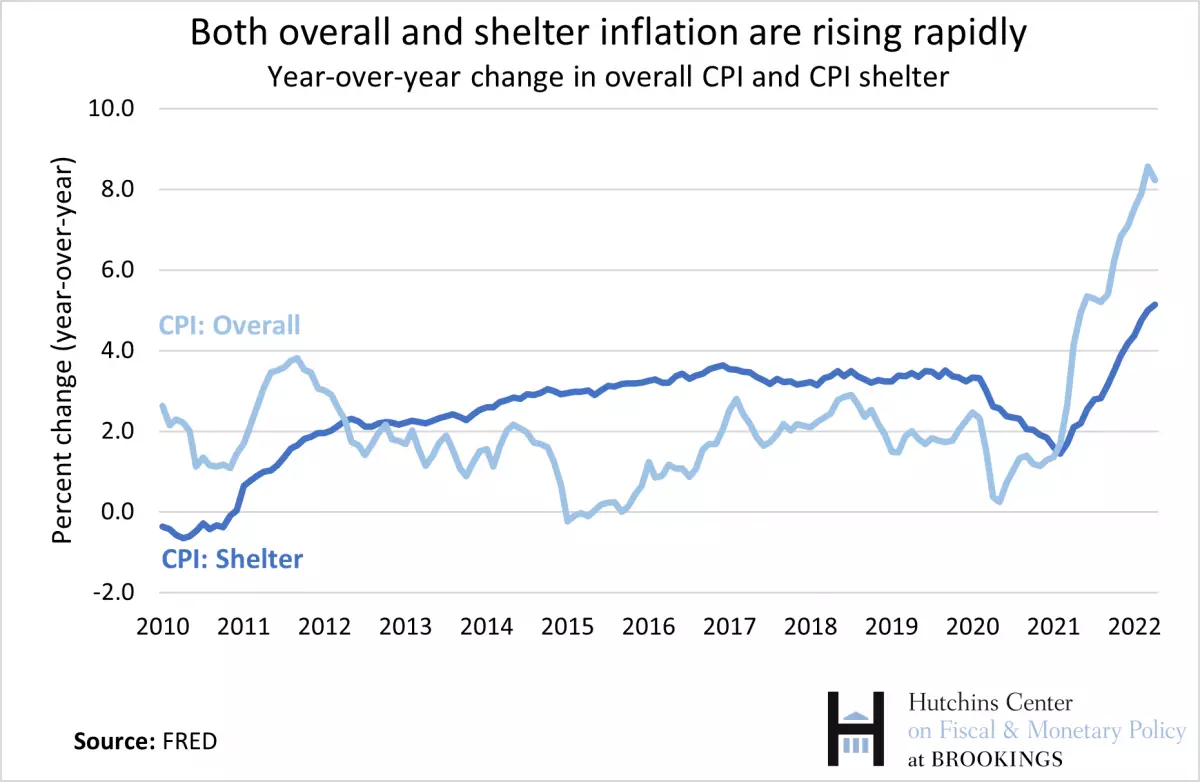

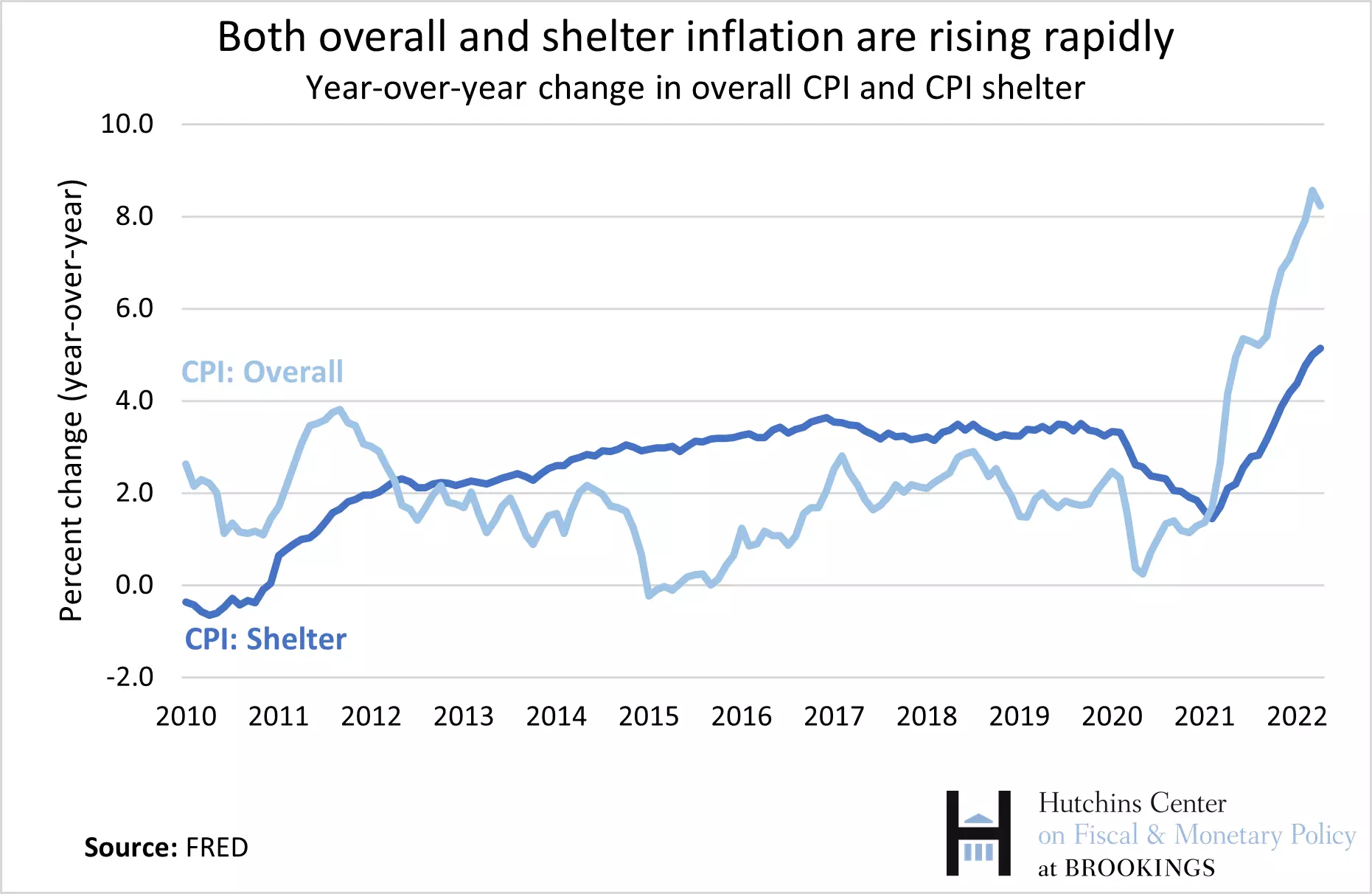

Year-over-year change in overall CPI and CPI shelter

Year-over-year change in overall CPI and CPI shelter

Housing plays a significant role in the Consumer Price Index (CPI), which tracks inflation. In early 2022, the price of shelter, also known as housing, contributed to an increase in inflation. However, measuring changes in shelter costs is more complex compared to other products. Let's delve into how the Bureau of Labor Statistics (BLS) calculates the cost of housing for both renters and homeowners.

How Does the BLS Calculate the Price of Shelter?

For tenant rent, the BLS takes into account the cash rent paid to the landlord for shelter, including any utilities included in the lease. Additionally, government subsidies paid to the landlord on the tenant's behalf are considered.

In the case of homeowners, the BLS determines the cost of shelter by calculating what it would cost the owner to rent a similar place. This is referred to as Owners' Equivalent Rent (OER). The cost of utilities paid by homeowners is measured separately in the CPI.

Why Does the BLS Use Owners' Equivalent Rent (OER) instead of Home Prices?

The purpose of the CPI is to track the price changes of goods and services consumed by households over time. When it comes to housing, the BLS aims to measure the cost of the consumption value of a home, which includes the shelter services provided, not the change in the value of the house itself. Therefore, the BLS uses OER to measure the cost of shelter for homeowners.

For example, if a family buys a house for $300,000 in 2022 and lives there for the next 10 years, their housing-related cost of living is not $300,000 in 2022 and zero in the subsequent years. Instead, their housing-related cost of living is the amount they would have had to spend to consume the same amount of housing services provided by their owner-occupied home.

Where Does the BLS Obtain Data for Shelter Prices?

The BLS collects data on rent for approximately 50,000 residences through personal visits or telephone calls. To ensure the data remains representative, one-sixth of the sample is replaced each year. As rents do not change frequently, each unit's rent is sampled every six months.

To maintain the consistency of the CPI, the BLS adjusts for changes in the quality of the observed properties. These adjustments take into account factors such as the age of the property, neighborhood improvements, and any renovations made to the home, such as the addition of bathrooms or new air conditioning systems.

As the BLS only observes rent for renter-occupied units, they impute owner's equivalent rent for owner-occupied homes using the average rents paid for comparable rental housing within the same area.

Potential Problems with Measuring the OER

Finding rental housing comparable to an owner-occupied unit can be challenging. Often, predominantly renter-occupied neighborhoods are geographically separate from owner-occupied ones. In addition, housing characteristics can vary widely across rental and owner-occupied units within the same area. For instance, owner-occupied units may consist of single-family homes, while rental units may be multi-family buildings. Finding comparable rental housing is especially difficult for large, expensive single-family houses.

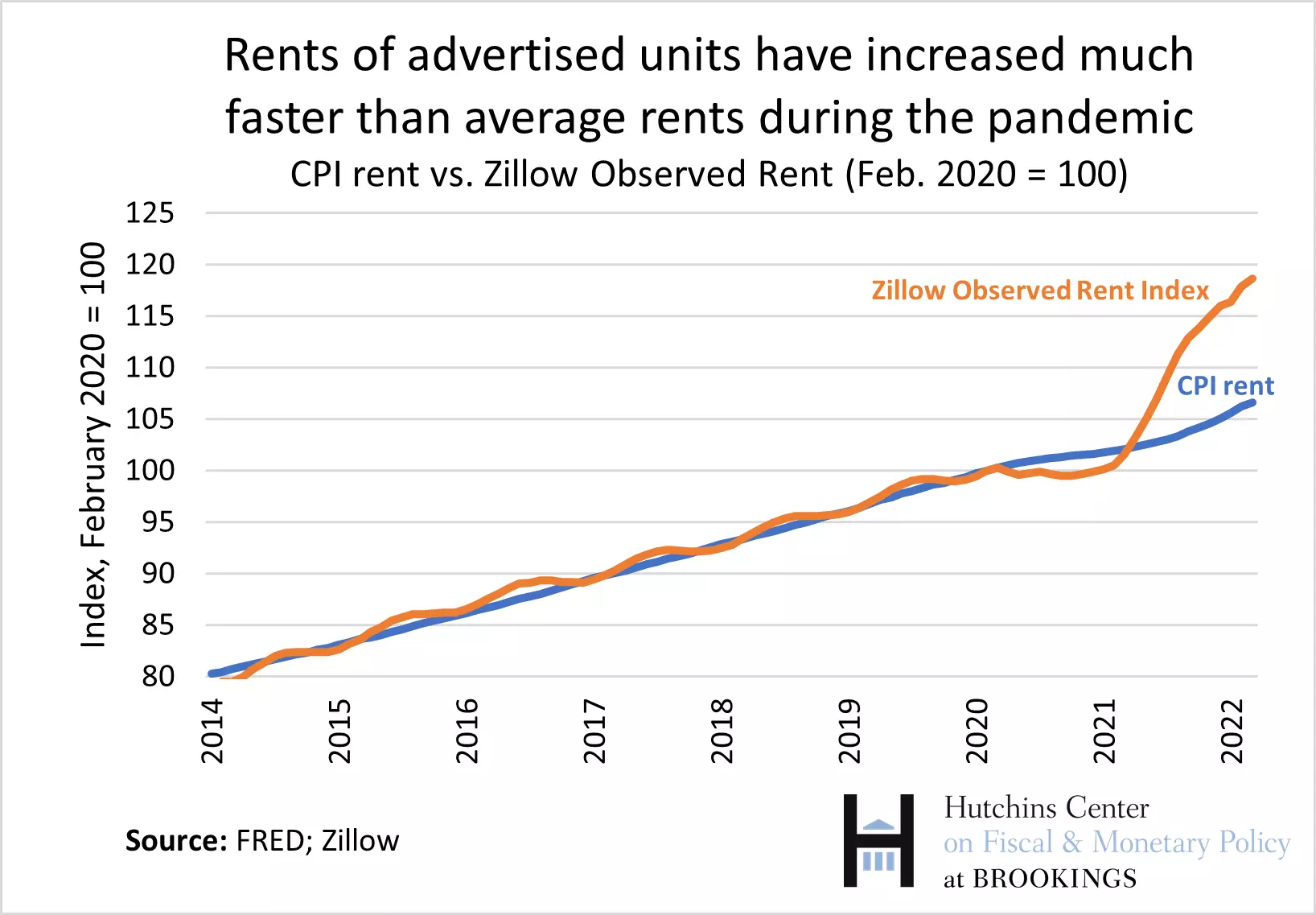

Discrepancies between CPI and Market Rent Indexes

You may have noticed headlines reporting faster rent increases than the CPI measure. Market rent indexes, such as the one published by Zillow, capture rents of units currently advertised on the open market. They do not account for rents paid by continuing renters, which the CPI does. Rents typically change when leases expire, which usually happens once a year. Therefore, there may be a lag between changes in indexes like Zillow's and those in the BLS's rent measure. However, from the perspective of the CPI, this lag is not an issue as it accurately reflects what households actually pay in rent. Nonetheless, the CPI's shelter inflation is expected to increase in the coming months as the tight housing market begins to impact rents on all rental units.

CPI rent vs. Zillow Observed Rent (Feb. 2020 = 100)

CPI rent vs. Zillow Observed Rent (Feb. 2020 = 100)

How Do House Prices Affect the CPI Measure of Homeownership Costs?

House prices and rental prices are influenced by supply and demand factors that do not always move in sync. For example, if demand for homeownership rises due to lower mortgage rates, house prices will increase, but rents may remain unaffected. Conversely, if home construction costs rise, both rental and owner-occupied housing prices are likely to increase.

Over time, changes in house prices do predict changes in rents, although the relationship is not a perfect 1-to-1 correlation and occurs with long lags. Research shows that house price growth has a correlation of approximately 0.75 with OER inflation after 16 months, and with rent inflation after 18 months.

Year-over-year change in CPI shelter vs. Case-Shiller National Home Price Index

Year-over-year change in CPI shelter vs. Case-Shiller National Home Price Index

What to Expect for the CPI Measure of Shelter Costs in the Coming Year

During the pandemic, the tight housing market led to a divergence between housing market prices and CPI measures of shelter inflation. Despite significant growth in private market-based measures of home prices and rents, government-measured residential services inflation was only four percent for the twelve months ending in January 2022, according to economists Marijn A. Bolhuis, Judd N. L. Cramer, and Lawrence H. Summers.

However, recent trends in rents and house prices suggest that the shelter component will boost the CPI inflation measure in the coming months. Analysts project that rent inflation will increase by about 7% in 2022 and 2023, almost twice the pre-pandemic five-year average. Considering that housing accounts for about a third of the CPI, these findings imply that housing will contribute to headline CPI inflation being approximately 1.1 percentage points above its historical average by the end of 2022.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, and individuals, as well as an endowment. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.