If you're looking to venture into the world of real estate investing, having a solid business plan is crucial to your success. Not only does it provide a roadmap for how you'll operate your business, but it also outlines your goals and measures of success. In this article, we'll guide you through the process of creating a winning real estate investment business plan, providing you with valuable insights and a free template to get you started.

Crafting Your Mission & Vision Statement

Every successful business starts with a clear mission and vision statement. Your mission statement should declare the actions and strategies your real estate investment business will use to achieve its objectives. It serves as your North Star, keeping your team accountable and guiding your success. Take the time to answer important questions such as what your business is, how you'll achieve your goals, who your target market is, and what your guiding principles are.

On the other hand, your vision statement is more inspirational and forward-thinking. It outlines what your business aspires to be once it has achieved its mission. Consider your primary goal, key strengths, core values, and the kind of global influence you want your business to have. By creating a compelling vision statement, you'll motivate yourself and your team to strive for greatness.

Caption: Example of a mission statement from Oak Tree Capital

Caption: Example of a mission statement from Oak Tree Capital

Conducting a SWOT Analysis

To set your real estate investment business up for success, it's essential to conduct a SWOT analysis. This analysis helps you identify your business's strengths, weaknesses, opportunities, and threats. By understanding these factors, you can capitalize on your strengths and opportunities while mitigating your weaknesses and threats.

Use the information gathered from your SWOT analysis to set goals that support your strengths and opportunities, and take steps to address your weaknesses and threats. Keep in mind that your SWOT factors may change as your business grows, so regularly revisit and update your analysis.

Choosing the Right Investment Model

When it comes to real estate investing, there are various investment models to consider. Each model has its own benefits and is suited for different situations. Some common models include:

- Buy and hold: Renting out properties and earning regular rental income.

- Flipping properties: Buying, adding value, and selling properties for a profit.

- Owner-occupied: Living in a property while renting out extra units.

- Turnkey: Buying properties that are ready for investment without the need for renovations or tenant management.

Consider your expertise and the current market conditions when selecting an investment model. You can even have multiple models within your portfolio to diversify your investments and maximize returns.

Setting Specific & Measurable Goals

SMART goals (specific, measurable, achievable, relevant, and time-bound) are essential in any business plan. When setting goals for your real estate investment business, be as specific as possible. Whether it's the number of properties in your portfolio or a particular return on investment (ROI), ensure your goals are measurable and achievable within a given timeframe.

Remember that your goals don't have to be solely property-related. Consider setting goals in other areas that can contribute to your business's growth, such as networking or public speaking skills.

Crafting a Compelling Company Summary

Your company summary provides an overview of your business, its services, goals, and mission. It's a chance to differentiate yourself from the competition and attract potential investors or partners. Customize your company summary to your target audience, highlighting aspects that are most relevant to them.

Include information about your business's legal structure, location, and goals. If you're seeking outside investors or partners, focus on profitability, investment strategy, and business structure. Understanding your legal business structure is crucial, as it affects liabilities and tax obligations.

Developing Your Financial Plan

The financial aspect is a crucial part of any real estate investment business. Determine where your funding will come from for property acquisitions, whether it be personal assets, lines of credit, or external investors. Consider various lending options, such as mortgages, FHA loans, home equity lines of credit (HELOC), private lenders, and hard-money loans.

Create financial projections to understand your investments' potential income, profits, and future funding needs. Use rental property calculators to determine a property's return on investment, taking factors such as purchase price, operating expenses, and monthly income into account.

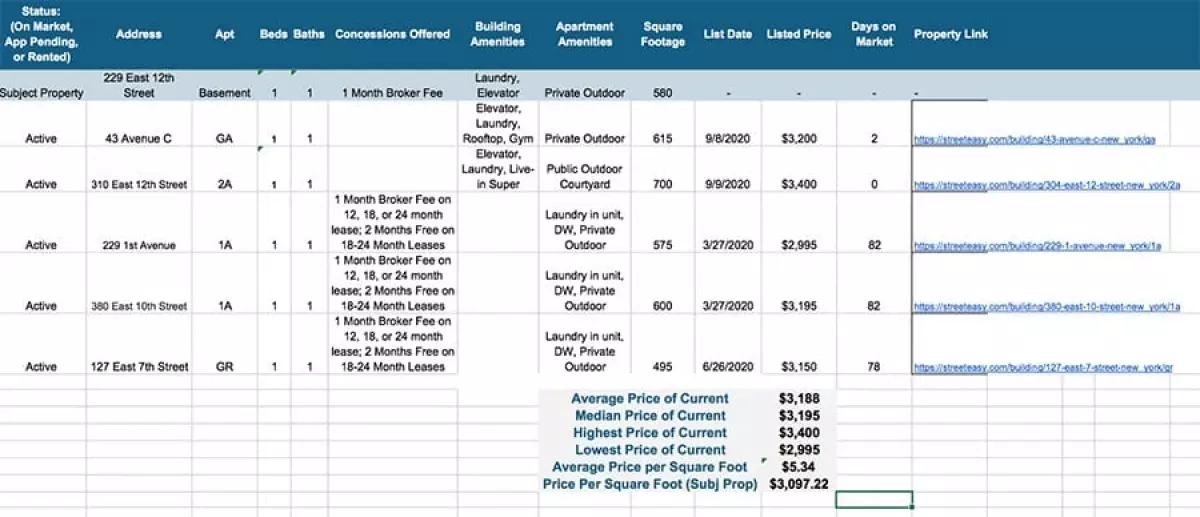

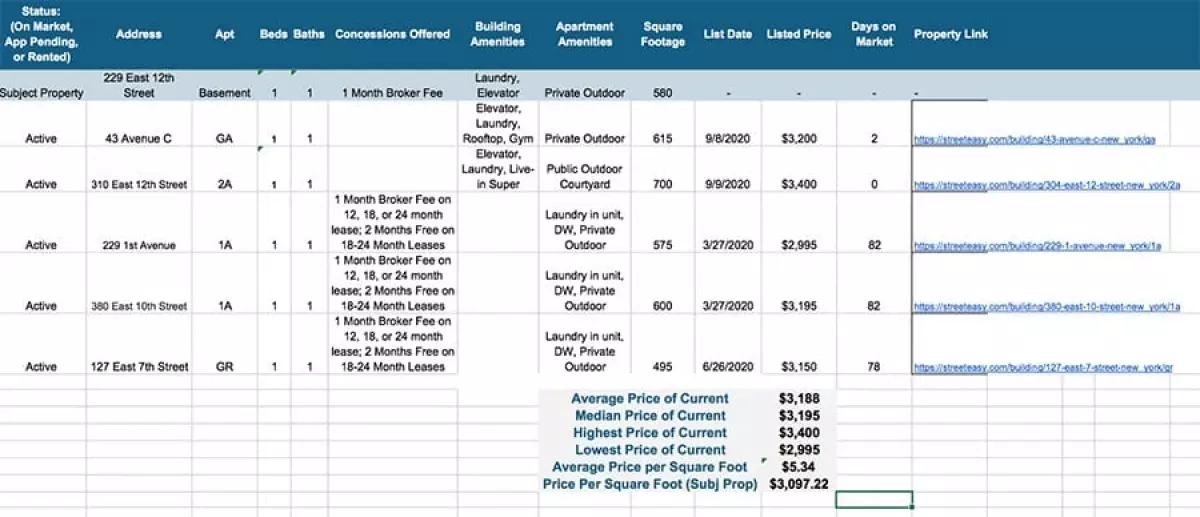

Caption: Example of a rental market analysis template from Fit Small Business

Caption: Example of a rental market analysis template from Fit Small Business

Designing an Effective Marketing Plan

A marketing plan is essential for attracting tenants and potential buyers for your properties. Identify your target market, competitors, and unique selling offers. Develop marketing strategies and tactics specific to different mediums such as real estate websites, email marketing, social media advertising, and print materials. Balancing your marketing efforts across various channels will help you reach a wider audience and achieve your goals effectively.

Caption: Real estate marketing materials

Caption: Real estate marketing materials

Building a Reliable Team & Implementing Systems

While you may not have a full team of employees initially, it's crucial to have a list of reliable vendors to support your real estate investment business. Contractors, plumbers, electricians, property managers, accountants, and attorneys are just some of the professionals you may need to rely on. Additionally, utilizing real estate investing apps and property intelligence software can help automate tasks and streamline operations.

Creating an Effective Exit Strategy

An exit strategy is a plan for when you want to remove yourself from a deal or the business altogether. It helps minimize financial loss, recoup investments, and avoid unforeseen fees or tax consequences. Consider factors such as market conditions, profitability, and personal circumstances when devising your exit strategy.

Remember, your real estate investment business plan is a dynamic document that should be regularly revisited and improved. As your business evolves, adapt your strategies to align with your goals. With a well-crafted business plan, you'll be on your way to achieving success in the competitive real estate investment industry.

Conclusion

Creating a winning real estate investment business plan takes time and careful consideration. Use our free template as a guide to help you get started. Remember to be specific with your goals, conduct thorough market analysis, build a reliable team, and always have an exit strategy in place. Continuously reassess and refine your strategies to ensure your business's growth and success. Good luck on your real estate investment journey!